We often see others growing in their financial life easily. Everything seems like a cakewalk for them when it comes to Finance. This hits us hard and sometimes makes us feel worthless.

In disappointment, we ask ourselves why we can’t understand finance. Why it’s me only who is unaware of money management and financial knowledge?

And Why Is It Important To Understand Finance? Right!

Don’t trouble yourself, you are not the only one to feel this.

Many have experienced the same emotions too including me and it took time for me to figure it out. The answer is simple.

Either we never had an environment to observe and understand Financial education or we simply didn’t care to learn Finance before in life.

In my case both the reasons were there. Here we will know the causes that stopped you from understanding finance and easy solutions to overcome them in a very simple way.

Finance Is Not Taught in School!

The very first culprit behind your financial ignorance is your schools. Yes, the axis of your education revolution. No doubt your School has prepared the foundation of your career (whatever you are pursuing).

But they do lack in teaching one of the most crucial aspects of life, finance awareness and management.

Though our first school is supposed to be our home, we learn a lot at home with family. But how many families and their members know financial literacy?

A few might be!

Money management education and financial literacy are essential for every student and society too.

Schools are still unaware of the fact that their students are simply not going to earn only but they will need to save and manage their money wisely in the future.

One can not have a sudden desire to learn finance and become a master in it just after completing a short course. It never happens that way.

What Is The Need to Learn Finance?

If we had no financial background in our school-college days, it is more crucial for us now to remember why we don’t understand finance still.

Like any other knowledge and skill to thrive or survive in life, Finance is also a compulsory tool to live your life to the fullest.

Strong financial knowledge and skills help people to achieve their financial freedom in life.

Learning finance increases your analytical power to deal with money issues. It certainly supports people in maximizing their wealth and enhancing spending capacity.

In my case, I learned that understanding finance boosts your self-esteem as you become self-dependent in managing your funds and savings.

You become a person who just doesn’t earn but learns how to make money from your money. Once you know the need for it in your life, you will start exploring answers to learn it ASAP.

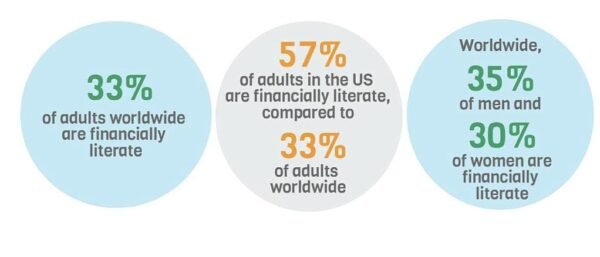

Only 33% of Financial Literacy in Adults Worldwide!

If you have been scratching your head for ‘Why don’t I understand finance’, don’t worry, almost two-thirds of adults around the world are in the same situation as you are.

Yes, It is true. S&P GLOBAL FINLIT SURVEY has confirmed it in their survey.

The survey was conducted in over 140 countries and based on interviews with more than 150,000 adults.

The top 10 most financially literate countries that secured their position in the survey were Denmark, Norway, and Sweden each with 71% literacy and placed #1.

Canada and Israel tied with 68% and got #2. While The United Kingdom with 67% came at #3.

Germany and Netherlands followed with 66%, Australia with 64% and Finland with 63% literacy.

You might be shocked and you must be, The United States Of America hasn’t found a place in the top 10 list and it stood with 57% literacy. 11% behind its tiny political ally Israel (68%)

Women lag in Financial Literacy More than Men

This survey report is not an alarm bell for adults and youngsters around the world, but it also reveals another horrible truth about women.

Where 35% of men around the world were found financially literate in the survey, only 30% of women have gained that blessing.

This 5% margin may look short on numbers but in reality, it is one of the major reasons behind the lack of empowerment, self-dependency, health, and self-care in women.

Because of a lack of financial literacy, many women are unable to access banking and financial services in their city and country. This affects a lot on their country’s economy too.

This leads to their dependency on men thus shutting the door to upcoming opportunities and self-development.

You may understand now why financial literacy is highly important to every person especially womens’ financial well-being and to the overall health of a country’s economy.

Graphic Source: S&P

Graphic Source: S&P

Financial Illiteracy- Americans lost $824 Billion!

This is going to be one of the biggest reasons for you to put learning finance on your priority list.

Where financial literacy makes people able to save and earn a lot maybe $1 million if the odds are in favor of them. On the contrary Financial illiteracy certainly causes them loss of billions, a lot of billions.

American adults lost an estimated average amount of $1,506 in 2023. This was followed by $1,819 in 2022 because of lacking knowledge about personal finances.

A survey by the National Financial Educators Council (NFEC) revealed that financial illiteracy cost 254 million adult Americans more than $436 billion loss in the year 2022.

While in the year 2023, approximately 258 million adults live in the U.S., lack of financial literacy costs them a total of more than $388 billion loss.

Money Lost 2023 2022

$0-$499 39.42% 61.80%

$500-$999 18.7% 7.23%

$1,000-$2,499 19.81% 7.96%

$2,500-$9,999 13.24% 7.98%

$10,000-more 8.83% 15.04%

Is It So Hard to Understand Finance?

The straight clear-cut answer to this must ask question is YES and NO. What does it mean?

The straight clear-cut answer to this must ask question is YES and NO. What does it mean?

Why are there two contradictory answers? The reason is as simple as it applies to every other skill.

Let’s go back to your kindergarten days (if you still remember all those fun and memorable times).

Were you that smart who write the alphabet and Numbers without mistakes? No one could. We all made mistakes and found it hard to scribble it.

I remember I used to write C, B, or D with opposite faces (mirror image). A few months passed and we all were masters in the alphabet and counting. Right!

Yes, Finance requires learning new vocabulary, meanings, terms, and even some rules. It requires your regular time and a pinch of interest.

The same way the alphabet and Number Counting required us in our pre-nursary days.

You have just to visit Finance Learning daily. With minimal effort and a little time spent on daily reading/learning finance, will result in huge benefits in a few months.

Always remember Everything is hard before it gets easy!

Importance of Learning Finance in Life

Learning finance is like having Vitamins and Minerals in our daily diet. One could survive without Vitamins and Minerals but would not be healthy and fit for a happy life.

Though there are countless importance of learning finance, here I would tell you 10 simple, easily adopting reasons.

- Financial literacy prepares you for unexpected emergencies in life.

- It teaches you a precise understanding of the time value of money.

- You become a person who Makes better financial decisions in life.

- Financial learning helps you in reaching your goals and achieve targets.

- Gives you insights into understanding investment opportunities.

- Transform you into a person who understands the value of saving and investing.

- It helps you to be aware of overspending, which you were never aware of.

- Manage your personal and professional life in a better way.

- It helps you acquire maximum returns on your investments.

- Learning finance increases your analytical skills.

Can I Learn Finance With No Financial Background?

Many beginners doubt themselves especially those who have no prior financial knowledge. They often believe it is next to impossible to learn finance without a finance background.

But this is very untrue. Of course, having a financial background helps but YES any newbie can learn finance with simple basic rules.

The first one is precisely knowing ‘Why’ you want to learn finance. The deeper your answer is, the better chances you will have to learn finance.

Second, give your dedication and regular time to learn finance.

Third, begin with simple steps, and don’t be harsh on yourself in expecting early results.

Don’t try to grasp all things at once. It won’t help you. Select easy-understanding terms/Information in finance you are already familiar with.

Try to start with Savings, FD-RD, Bank interest rates, and their schemes, Investments in SIP, Gold, Sovereign bonds, Term plans, Health insurance, and retirement plans, if it suits you.

You can understand the fundamentals of financial literacy here as a beginner with easy steps and it won’t cost you! How To Understand Finance For Beginners: Quick and Easy Guide

How Can I Get More Knowledge About Finance?

Reading is not just food to your mind but it is a blessing too for learning any new skill. Since finance is also a skill you must start reading a national/local business newspaper/magazine published in your mother tongue.

You can also go for famous economics papers/websites such as Moneycontrol, The Economist, The Wall Street Journal, The Minta, The Economic Times, Business Standards, etc.

It will help you to know basic as well as important financial terms and information.

Make contacts with those who have similar financial goals and interests as you have. It supports your aim and keeps you moving ahead.

You must join groups on social media related to free finance education for extended learning.

But Beware! Never invest or put your money there if anyone says so.

Start reading books on finance empowerment. This habit will train your mind to learn and focus on your learning goals.

You must follow and read Blogs based on finance insights and learning. This will boost your morale and keep your rhythm smooth.

FAQs

Can I self-learn finance?

Yes, you can learn about basic finance yourself. Online courses, in-person classes, and self-teaching from finance books will help you a lot.

What topics come under finance?

Savings, Budgeting, Personal Finance, Investing, Credit, Loan, Share market, Money management, and Debt are some major topics that come under finance.

Is learning finance good for a career?

Yes, learning finance just doesn’t help in a career but in life too. A career in the Finance sector can be well rewarding and satisfying.

Does finance have a future?

Learning finance is always beneficial to anyone. As a career, the finance industry is rapidly evolving. The future of this industry can promise you a plethora of professional opportunities.

Conclusion

Learning is always a beautiful journey of life. It always gives you a path to grow and be better.

Even though not have a financial background, you can start this journey with discipline and dedication.

You just need to take your first step and keep going slowly but at a steady pace.

Are you going to take your first step towards finance learning? Or you will be the same person who will keep complaining in the future, Why don’t I still understand Finance?