A job provides you with a regular source of income that you need to pay all expenses and run your life. It also gives you a feeling of financial security, yet 9-5 is not the first choice for many.

A job provides you with a regular source of income that you need to pay all expenses and run your life. It also gives you a feeling of financial security, yet 9-5 is not the first choice for many.

The reason is a job gives you a fixed amount of money as a salary while business and self-employment offer high income potential and massive growth.

We have been trained right from our childhood to become employees, not entrepreneurs. Our parents, school/college, teachers/mentors, peers, society, and employers trained us on how to finish our education and find a good job for a living.

This is why you have to unlearn a lot, that you have forcefully gained since childhood if you are looking for ‘How To Be Financially Independent Without A Job?’.

Achieving Financial independence, especially without a job is possible. But this will not be your cup of tea if you are not committed to keep learning and working more than 9-5 hours.

But if you are committed and put all your efforts into knowing ‘how do I move out and become Financially Independent’, this road is for you.

In this article, we will discuss what important steps, habits, and skills you will need to achieve your goal to make money fast without a job.

Let’s dive in.

Master A Skill- Stand Out Yourself

The first and only criterion to fulfil the need to be financially independent without a job is to Master at least one skill.

A skill that is in high demand in the market and highly valuable for the growth of businesses. Every business needs those ‘extraordinary’ who can boost and capitalize on them.

Here mastering a skill means you should be superb in what you do so that the market (people) can’t ignore you.

A skill that presents you as an expert in that particular field and positions yourself, so that no one can be considered as your option/replacement easily.

Take examples of

Warren Buffet & Charlie Munger in Investing

Ronaldo-Messy in Football

Micheal Phelps in Swimming

Michael Jordan/LeBron James in Basketball

Albert Einstein/Stephen Hawking in Science

Nelson Mandela/Abraham Lincoln in Politics and Leadership

They all were legends in their field. You don’t have to be a legend like them to be financially independent without a job.

You just need to take inspiration from them. Find out your area of interest, and learn the skill that best suits your passion. Work on yourself to be better, smarter, and unique.

When you do this, you can charge higher prices commensurate with your quality work and time. And guess what people would be willing to pay for it without blinking.

You Need To Be Very Creative

Creativity is your second best mate to meet your golden destiny when you don’t have a job and searching for how to become financially independent from nothing.

Creativity allows us to come up with totally new perspectives, ideas, solutions and even mindsets that nobody has ever thought of before.

It gives us the power to see a problem from different angles and find out its unique and better solution with more innovations.

You will be amazed to know that creativity can outsmart any skill and create a charm in your work with increasing followers/consumers or customers.

There are no. of high-demand skills in our present era that pay handsome. But what if you simply have the skill of maintaining peoples’ gardens?

If you have mastered gardening and are also creative in doing so, you will probably be among the top 10 gardeners in your city, if not number 1.

And then what?

People will go crazy to book your service to make their garden as beautiful as an oasis in the desert. This will not only bring you fame but will also earn you a lot of money regularly.

If there is no creativity a person, a company or even a big business is completely unable to introduce necessary changes or solutions with more effectiveness.

They can’t provide new innovative ways to analyse, observe and understand the actual needs of the people around them.

As we see this world has become more and more competitive with every passing day, so it’s going to be very important for anyone to have a pro-level skill with a deep touch of creativity in their toolbox.

When you have mastered a skill, creativity is the best tool that can blend well with your skill and provide you with amazing results.

Understand True Wealth Is TIME Not Money!

In my life, I have met people who are not doing any job (pursuing skill-based work) but still have a desire to know how to become financially independent without 9-5 working hours. And It’s completely sane.

But this desire or dream may never come true if one doesn’t understand that true wealth is not money but Time and how to utilize time to maximize wealth.

It’s not only philosophical or spiritual but logical too.

How?

In your life, you can earn a lot of money. Practically you can have no limit in money making but time is finite for everyone. No one can increase the hours in their 24-hour day or even their life span.

Let’s understand a little more by the Time-Value concept but first remind yourself

Time is more valuable than money. You can get more money, but you cannot get more time”

– Jim Rohn, American entrepreneur and Author/Speaker

Concept Of Time Value

The concept of time value is taken from the financial management. It defines that the value of money today will always be greater than its value in the future.

Take it as the value of 1$ in 2000 was greater than its value in 2024 in INR.

This means the value is always time-based. There are two remuneration systems, 1- time-based remuneration, and 2- value-based remuneration.

When you are paid according to the time spent delivering goods or services it’s called a time-based remuneration system. Ex- A teacher taught in a school for 3 months and he/she is being paid for 3 months’ salary.

In a value-based remuneration system, you are paid for delivering the value. Ex- Netflix hires a director for a movie project and at the end, he/she gets paid for the quality of work regardless of time.

In the latter case, one has a bigger opportunity to earn huge money and self-brand value than former case.

Americans Start Valuing Time Over Money

The USA holds the #1 in the top 10 largest economies in the world. One of the most prosperous and powerful countries in the whole world.

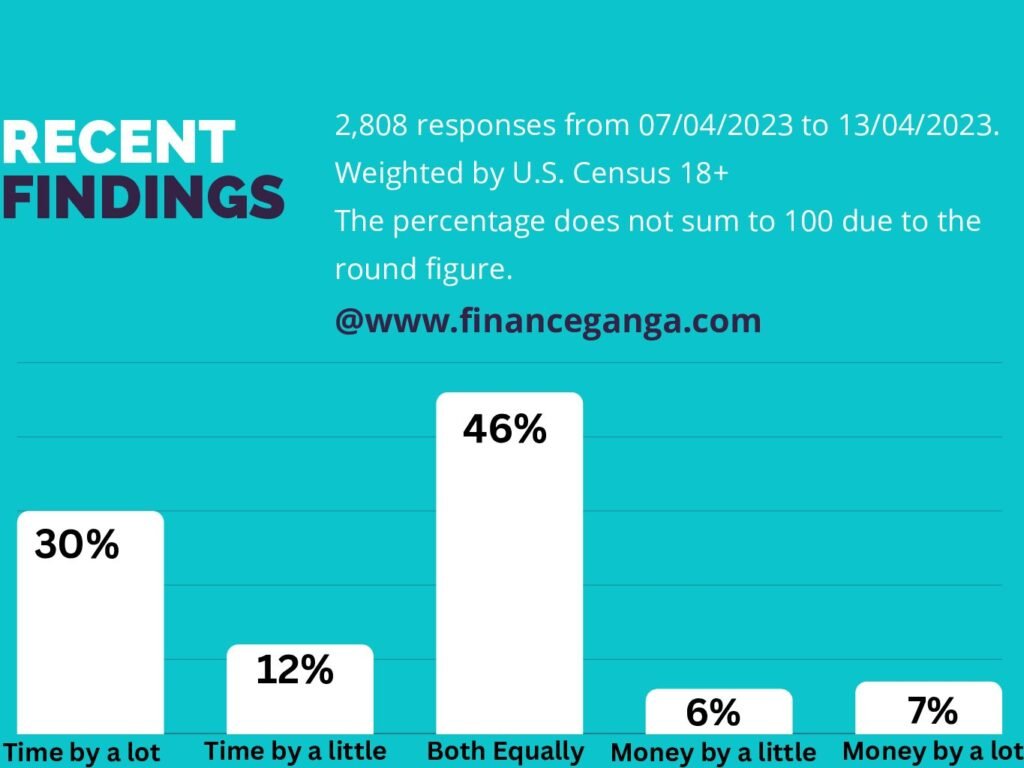

Last year a report based on a survey revealed Americans have started valuing their time over money. In this survey every 4-in-10 (42%) Americans value time over money.

On the other hand, 46% of Americans say their time is equally important as money. While fewer (13%) Americans value money over time. They say money is more important to them.

Rich People Earns Time, Poor Waste It

Rich people not only have a different mindset from the poor, but they also know how to ‘buy more time’ to build their fortunes.

Rich people always give priority to time over money. They prioritize their tasks every day so that lesser-quality projects don’t ruin their day.

This way they save their energy and time and use it for bigger and far greater projects that benefit their success and growth.

On the other hand, poor people sell their time for money to live and then use the remaining time for their entertainment. The reason lack of bigger goals and not prioritizing the tasks.

If you are searching for ‘How can I be financially stable without a job?’ remember, to become truly financially independent, you must find a remuneration system that beats time and provides high value.

Working a 9-to-5 job will certainly not beat time. Value your time more than money and use this saved time to generate extra income and then again save more time with this extra money and keep running this loop.

Your Habits Are Guarantee, Not High-Income

How Do You Build Wealth From Nothing?

People generally think and believe hard that to be financially stable without a job, they must have an earning of high income. But on the contrary high income has nothing to do with financial independence.

Financial independence is more about your spending habits and saving strategy than just how much you earn. The more you focus on saving, budgeting and investing, the more you generate wealth.

Whereas being a slave to excessive spending habits destroys all your chances of becoming financially stable. You still don’t believe this?

OK, take a look at 2 examples and decide for yourself.

Lesson From Billionaire Buffett Vs Millionaire Susheel

Business and Investment mogul Warren Buffett is currently no.7 richest person in the world with 131.5 billion $ net worth.

Warren Buffett is equally known for his investment/business acumen and frugal lifestyle. You will be amazed to know that:

- Warren Buffett lives in the same house he bought in 1958 in Nebraska.

- Buffett buys and drives reduced-priced cars instead of costly luxury cars.

- Warren doesn’t go to luxurious and high-priced restaurants. He starts his day with a cheap breakfast from McDonald’s.

- Buffett was never interested in working in the New, Bigger and Stylish office. He has worked in the same office building for more than 50 years.

- Buffett used a Nokia flip phone for years even long after smartphones were introduced.

- Warren Buffett keeps thinking ‘Outside the Box’ just to save money. Can you believe this?

- Warren is never ashamed of wearing normal business suits. He doesn’t wear designer suits

- His hobbies are also frugal and cheap. He loves to play bridge card games.

Now come to Susheel Kumar, an ex-millionaire, from Bihar, India. Suheel Kumar won 5 crore or 50 Million INR in a Quiz show KBC (Hindi adaptation of ‘Who Wants To Be A Millionaire’) in 2011.

It was the very first time that someone won 50 million INR in any quiz show. The Whole Nation including Susheel Kumar and his family believed the fortune had come for him.

But a disaster knocked down Susheel. By the year 2016, he has ruined all his fortune. His 5 crore wealth was destroyed by Lending money to relatives, renovating his home, and lavish lifestyle expenses.

He started business in partnerships but it didn’t work. In depression, he started smoking, boozing and other addictions and became the victim of heavy debt and loans.

Tips for Financially Stable Without High-Income

NOW you believe your high income is not the guarantee of your goal ‘To Be Financially Independent Without A Job’ but your good habits. Right!

But what to do even if we have unlocked the secrets of How To Make Money Fast Without A Job and become Financially Independent?

Here we go.

Live a Frugal Lifestyle – Regularly track your daily/monthly expenses and crop down your unnecessary spending. Always remember every coin saved is a coin closer to your goals.

Focus on Debt Repayment – If you have debt, start Start by prioritizing the repayment of your smallest balances. By doing so this initial progress will serve as a driving force to tackle your larger debts with renewed motivation.

Give priority to high-interest savings – When you have learned and started earning well with the help of your master skill and creativity, let’s make your money work for you. Find out high-interest savings accounts and other investment options to grow your wealth over time.

Embrace the Potential of Budget Management – You must create a budget that allocates your income regularly towards essential expenses, savings, and investing. Stick to your budget. Many free budgeting apps can help you track your spending and save you from overspending.

How Much Money Do You Need To Support Yourself, can be a great help not only in effective budget-sheet making but figuring out the amount of money you will need to live a happy life.

Start side hustles – It’s good to earn from your skills but it’s even better if you look for ways to generate additional income. This not only keeps you on track but also helps you learn and try something new and earn at the same time. This could be freelancing, selling crafts online, or renting out a spare room.

Learn To Make Money Outside 9-5 Hours

- Stay in your current job (even if you don’t find any charm in it) until your side business or freelancing becomes stable and generates equal or more income.

- Identify your unique talent. Analyse what sets you apart from others. Find out what you are exceptionally good at. Use that talent to grow and make yourself Unique.

- Continuously improve your skills. Keep striving for excellence in your talent. It will help you become a brand in your field.

- Keep exploring ways to monetize your talents or skills. It may require further education or research. The more ways you find the more sources of income you will be awarded.

- Use various marketing strategies to promote your talent effectively around the world such as social media, advertisements, and mouth publicity.

Embrace Work From Home

15 years ago If someone had asked me ‘How Can I Be Financially Stable without A Job? I would have been almost clueless. But today things have changed a lot.

If you are not pursuing any job either because there is no vacancy or you want to be your boss there are many ways to earn good money.

You can start a small-scale business or begin work from home or an online business from home. There are thousands of REAL work-from-home jobs to do. Many of them pay well.

Start work from home with the skills you have mastered. Use your full creativity to provide the best service or product you can. Establish yourself as a brand gradually. Get your paychecks.

If you save enough money, invest it into a side hustle (start a business alone or with trust-worthy partners).

If your side business grows well and becomes the main source of good income you can start quitting your work-from-home slowly so that it doesn’t affect the income you need most in such a crucial period.

Work-from-home requires more hours of work than a 9-5 job. It needs more dedication, time management, on-time results providing responsibilities and great communication with collaboration skills..

9 Habits For Financial Freedom

If looking for an answer to ‘How Do I Move Out and Become Financially Independent?’, you must practise some good habits. Habits that will change your course of life towards financial freedom.

here are some good habits to learn and adopt for a lifetime.

1. Make individual goals in life

2. Create a monthly budget and stick to it

3. Minimize borrowing and avoid any loan if you can.

4. Set up automatic savings

5. Begin investing without delay

6. Negotiate for products and services

7. Stay updated on financial matters

8. Maintain a Lifestyle Below Your Means

9. Take Care of Your Health

Conclusion

Financial independence is a journey, not a destination. It takes time, patience, discipline, continuing learning and applying new things and some sacrifices too.

But with the right approach, anyone can build a secure financial future, regardless of their, job or income level.

You need to decide how much you want to earn and how much money would be enough for you to live your life efficiently.

Once you figure it out, you need to start earning with your master skills, start investing and find ways to generate passive income in the long run.

This will help you become financially independent even though you skip a job.

Good Luck.

This is a good tip particularly to those new to the blogosphere.

Simple but very accurate info… Many thanks for sharing this one.

A must read article!

We are so glad to hear this from you.

This is a good tip particularly to those new to

the blogosphere. Simple but very accurate info… Many thanks for sharing this one.

A must read article!